EUROPE´S PREDICAMENT AND ECB FURTHER RATE CUTS

ECB´s STAFF NOTE ALSO UNDERMINES THE USE OF ANY ESTIMATE TO DECIDE ON MONETARY POLICY

THE ECB SHOULD CUT RATES FURTHER AND IGNORE THE USELESS "NEUTRAL" RATE.

I- Considering recent soft indicators, the Euro area is bound to show this year's economic growth below 1%, even before any inclusion of US tariff effects. However, Trump already announced 25% across-the-board tariffs on European imports and was unclear about imposing additional car tariffs. A spokesperson for the EU announced that there would be an immediate and firm retaliation from the EU side. Trump said "The EU was created to screw (sic) the US", showing his hostility towards Europe in sync with his shift in external policy towards Russia, whose conditions to agree on a Ukraine war settlement he already supported publicly.

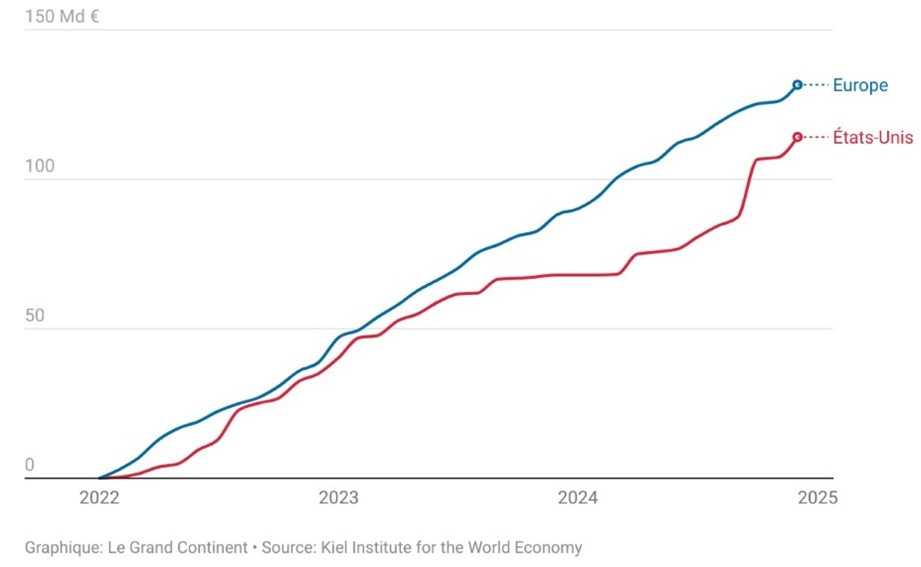

We can no longer ignore the possibility, however small, that a hidden Trump/Vance/Musk objective is to break up the European Union and the Euro Area. The prospect of a US-Europe trade war looks strong, culminating in the end of any concept of the West or the effective existence of NATO. Europe will have to spend much more on defence and on Ukraine's support. Europe has contributed more than the US, and Trump has lied about it

CUMULATED AID TO UKRAINE

He used that as the basis for a shameful claim of Ukrainian mineral rights up to $500 bn over time, without any future security guarantees as those are "to be provided by Europe". It is worthwhile to reproduce Thomas Friedman in the New York Times (25th Feb): "Trump ..is looking to make a profit off Ukraine…while making no demand on Putin for reparations or promising any future US protection for Kyiv…Don Corleone would be embarrassed to ask for that. But not Don Trump."

The US policy shift will be detrimental to Euro Area growth, among many other things, including the US. It is not clear whether European fiscal policy may become more expansionary other than for defence. The future German PM said publicly all the right things about Europe not being able to rely on America, but it is still not certain that he is willing or able to scrap the "debt brake" fiscal policy straitjacket.

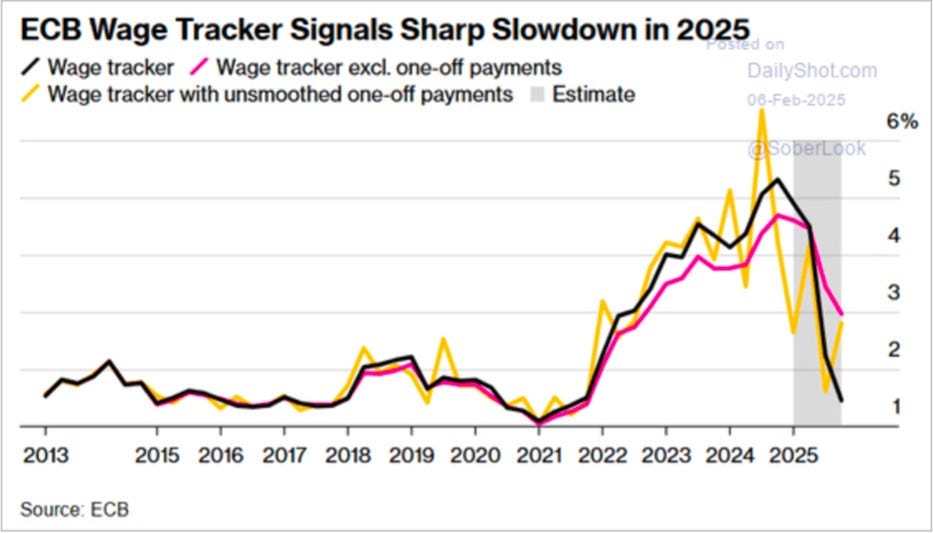

As inflation, under the circumstances, is bound to come under 2% during the year, the ECB must respond with a forceful monetary policy to the Euro Area predicament. The ECB can count on declining inflation after the year's early months, keeping it around 2.5%. Its wage tracker points to a sizeable drop in wage growth during the year, which is very important for inflation in the Services component. The ECB wage tracker indicator is important because it's based on signed wage settlements that will determine wage developments during the duration of such contracts. It is, therefore, forward-looking.

II – The ECB Governing Council members must ignore in their deliberations any consideration of the so-called "neutral rate" as I highlighted in a previous Post., Very likely, they will have to cut rates to levels below any empirical estimate of the upper level of the "neutral" rate.

In my previous Post on this subject, I mentioned that the ECB President had announced the publication of a staff document about the present state of the art concerning the neutral rate. This was indeed published, and I will now comment on it.

The ECB document, entitled "The natural rate for the euro area: insights, uncertainties and shortcomings" [1] practically agrees with my conclusion that the neutral rate cannot be used to decide policy. In fact, it states, "…the usefulness of r* as an indicator to support the calibration of the monetary policy stance is greatly limited, making it difficult to use as a rate-setting norm at policy meetings."

The ECB Note provides arguments that illustrate my three main objections to any use of the concept of the Natural/Neutral rate of interest for monetary policy decisions:

1. The confusing existence of many definitions and their empirical counterparts,

2. The huge uncertainty surrounding any estimates.

3. The insufficient effectiveness of the concept to explain and fine tune the control of inflation.

I will deal in what remains of this Post with those three points

1) In a recent well-known paper, Maurice Obstfeld (2023) [2] reminds us of the three main types of definition: "Wicksell (1898, p. 102) was more specific, defining the natural rate as the rate at which the demand and supply of Capital would be in equilibrium in a non-monetary economy – basically, the equilibrium marginal product of Capital under full employment and flexible prices. Woodford (2003, p. 9) identifies the natural rate with "the equilibrium real rate of interest in the case of flexible prices and wages, given current real factors." Laubach and Williams (2016) add another proviso that gives their definition more of a long-run flavor, "the real short-term interest rate consistent with the economy operating at its full potential once transitory shocks to aggregate supply or demand have abated."

I find that the three definitions refer to a long-term concept with no economic rigidities and vaguely defined. Obstfeld introduces a distinction between a natural rate (r-bar) and a neutral rate (r-star), the first being "…the real rate of interest prevailing in an equilibrium where price ̅rigidities are absent", and the second as "the real policy rate of interest that eliminates inflationary or deflationary pressures".

[ A parenthesis that can (and will) be ignored - Wicksell's definitions and Woodford's partial definitions point to an unattainable realm of economic activity where everything would happen in "real terms" without meaningful money. That is what Wicksell implies by the concept of real marginal product of Capital and Woodford by "the case of flexible prices and wages, given current real factors". These references correspond to the neo-classical vision that there is some sort of activity in real terms behind the monetary economy, implying barter or a passive "veil of money" or "numeraire" to facilitate the exchanges as in the General Equilibrium Theory (GET).

The "real marginal product of capital" concept recalls the famous dispute between the Cambridges (UK and Massachusetts) [3]on the use of the Aggregate Capital concept and calculating its real returns. The Cambridge-UK authors maintained that it was impossible because to aggregate Capital goods, we have to use prices, and these already contain a margin of profit or return that makes the aggregated quantity unusable to calculate a pure real return on "this" aggregated Capital. From that impossibility, significant consequences emerged for income distribution theory, for the concept of production function and for what became known as "neoclassical parables" In a 1966 paper, Samuelson famously and honestly recognised the Cambridge-US theoretical defeat: "If all this causes headaches for those nostalgic for the old time parables of neoclassical writing, we must remind ourselves that scholars are not born to live an easy existence, we must respect, and appraise, the facts of life" [4]

However, the consequences were such for economic theory that the whole issue was subsequently ignored in mainstream economics under the pragmatic excuse that we may use some approximations (returns from the stock market!?) cand the whole theoretical debate "had been a loss of time" (Sollow)

Anyhow, in an actual "monetary production economy" (Keynes), there is no such realm of "real" concepts providing some sort of anchor or necessary "points of attraction" for economic activity. So, the concept of "real" we can utilise is just the result of using deflators, many times precarious ones, to approximately make valuations comparable across time but belonging to a monetary economy. In our actual economies, money and finance are not neutral or simple veils, either short-term or long-term historical, chronological time, and not the abstract logical time of models.]

After this parenthesis, it is time to go back to the issue of the definition of the natural/neutral interest rate. The third type of definition, provided by Laubqauch/Williams, has short- and long-term elements that make it ambiguous. The "natural" rate operates the short-term macro equilibrium but also follows the rate of trend potential growth. It is, therefore, understandable that Obstfeld introduced the distinction between a natural and a neutral rate. The first is a purely theoretical concept impervious to any reliable estimate. The second is the one adopted in the remainder of Obstfeld's paper. It is also the definition used in the ECB paper: "r* is defined as the real rate of interest that is neither expansionary nor contractionary". The ECB document calls it a "natural rate" whereas Obstfeld gives it the more appropriate "neutral rate" name. We may assume that this refers to a short-term rate. Empirically, it remains the issue of defining to which rate the estimates refer to: is it the Central Bank policy rate, the overnight interbank market rate, or Treasury Bills or Bond yields, or something else? Which rate will be more meaningful to influencing the economy at a contractionary or expansionary rate? Will semi-structural or structural models refer specifically to the rate that the CB has to decide upon?

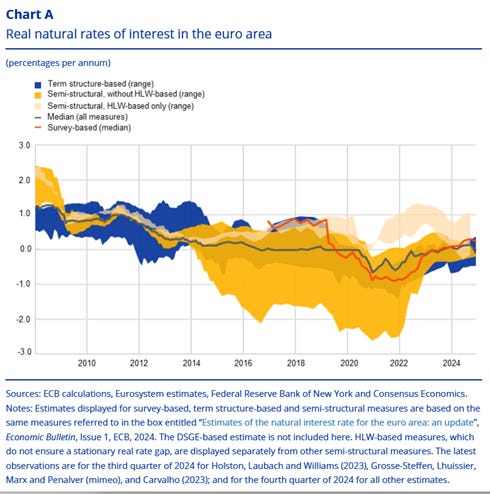

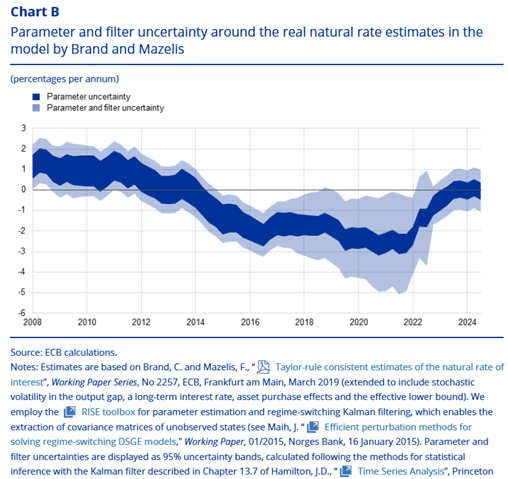

2- Assuming all those issues are well resolved, what are the results presented by ECB Note? "Taking only the measures shown in the dark blue and dark yellow areas that were possible to update to the very end of 2024, the most recent estimates of real r* span a range between -½% and +½%" These numbers do not use the Holton/Laubach/Williams model estimates that go only up to 2024 Q3, and taking the objective of 2% inflation imply a nominal range of rates -1.5 to 2.5%. However, "When the three estimates derived from versions of the HLW model are factored in, the range of real r* is -½% to 1% and the corresponding nominal range is 1¾% to 3%".

Naturally, even these ranges are subject to large margins of uncertainty, depending on standard deviations, the noise of filtering from data to the estimates (the Kalman filter), and the fact that using different samples changes the results. Such uncertainties, the resulting ranges and the ambiguities about which rates are involved make it impossible to rely on any particular estimate to make monetary policy decisions.

3- My third point refers to the fact that Wicksell's inflation model is exclusively related to the deviations of the "market rate" and the "natural rate," which is not adequate. In reality, inflation has many other drivers. As the ECB Staff Note puts it: "…the connection between an r* defined in terms of the short-term interest rate instrument of monetary policy and the broader economy may itself change, as monetary policy transmission depends on a broader set of financing conditions – including the cost and availability of bank credit, and prices in a range of asset markets. The link between the short-term interest rate instrument and broader indicators for monetary policy is state-contingent and typically not stable."

The relevant consequence implies that it is not enough to put the "whatever short-term interest rate is considered relevant and is estimated by the used method" equal to the "natural/neutral "rate, even assuming that we can reliably estimate it, to achieve an inflation target.

The media discussion of the "neutral" rate deviation from the policy rate, encouraged by central bankers' communication, is a dangerous red herring that should be dropped altogether.

Vítor Constâncio, February 27th 2025

[1] Prepared by Claus Brand, Noëmie Lisack and Falk Mazelis and Published as part of the ECB Economic Bulletin, Issue 1/2025.. Find it at https://www.ecb.europa.eu/press/economic-bulletin/focus/2025/html/ecb.ebbox202501_08~3be5a005f9.en.html

[2] Maurice Obstfeld (2023) “ Natural and Neutral real interest rates: past and future” CEPR DP. n 18685

[3] See G.C. Harcourt (1976) “ The Cambridge controversies: Old ways and new horizons- or dead end?” in Oxford Economic Papers , Vol. 28N.1 pp 25-65 ; Avi J. Cohen and G.C. Harcourt (2003) “Whayever happened to the Cambridge Capital Theory controversies?” in Journal of Economic Perspectives Vol 17,N 1 pp199-214

[4] Paul Samuelson (1966) “ A summing up” The Quarterly Journal of Economics, Volume 80, Issue 4 :

Among the then-well-known 5 “neoclassical parables”, we find the one referring to the necessary negative relation between the interest rate and “the quantity of capital” . It was proved in the debate that such a relationship is no longer a necessary one in a world of heterogeneous capital goods. Another disproved parable regards the income distribution theory, saying that capital-labour ratios and respective marginal products of the two factors determine their income.

Excellent post with an interesting historical perspective on the definition of the neutral/natural rate of interest. I would add that it is also important to keep into account global dimensions (both in terms of real and financial integration). These becomes particularly relevant for open economies and would add probably a further word of caution in relying on this concept.